essaytogethertunisia.ru

Community

What Is Deductible On Federal Income Taxes

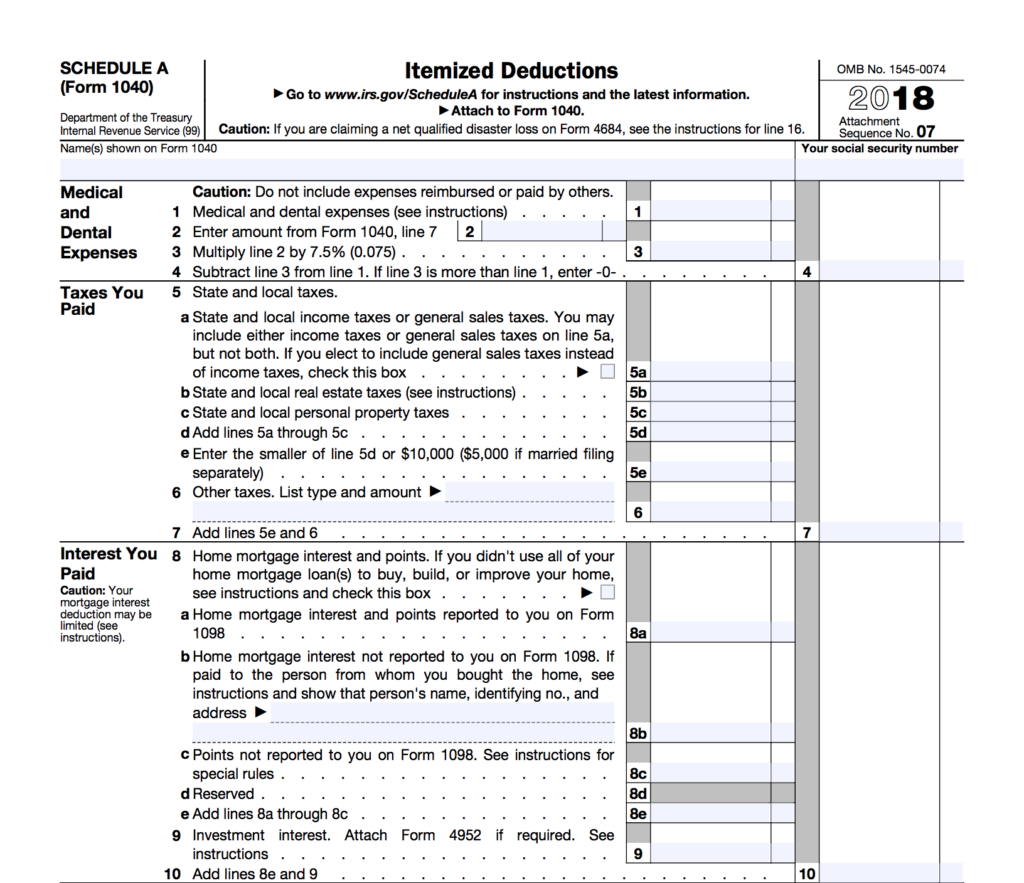

The amount of the deduction is the lesser of $5, or the actual amount paid by the taxpayer. If filing a joint return, the deduction is limited to $10, or. Internal Revenue Code (IRC) Section provides a deduction of certain taxes, paid or accrued for federal income tax purposes. Pursuant to Code Section What taxes can I deduct on my federal return? · State, local, and foreign income taxes, · Real estate taxes, · Personal property taxes (Ad Valorem tax), and. One of the most common tax deductions for homeowners is the mortgage interest deduction. This allows homeowners to reduce their taxable income by up to $, For the tax year, seniors filing single or married filing separately get a standard deduction of $14, For those who are married and filing jointly, the. The federal income tax allowable as a deduction is the net tax liability as accrued and subsequently paid, that is, the amount after subtracting all deductible. For tax purposes, a deductible is an expense that can be subtracted from adjusted gross income in order to reduce the total amount of taxes owed. A Bunch of IRS Tax Deductions and Credits You Need to Know · Child Tax Credit: · Earned Income Tax Credit (EITC): · Child and Dependent Care Credit: · Adoption. The basic standard deduction for is USD 29, for married couples filing a joint return, USD 14, for individuals, and USD 21, for heads of household. The amount of the deduction is the lesser of $5, or the actual amount paid by the taxpayer. If filing a joint return, the deduction is limited to $10, or. Internal Revenue Code (IRC) Section provides a deduction of certain taxes, paid or accrued for federal income tax purposes. Pursuant to Code Section What taxes can I deduct on my federal return? · State, local, and foreign income taxes, · Real estate taxes, · Personal property taxes (Ad Valorem tax), and. One of the most common tax deductions for homeowners is the mortgage interest deduction. This allows homeowners to reduce their taxable income by up to $, For the tax year, seniors filing single or married filing separately get a standard deduction of $14, For those who are married and filing jointly, the. The federal income tax allowable as a deduction is the net tax liability as accrued and subsequently paid, that is, the amount after subtracting all deductible. For tax purposes, a deductible is an expense that can be subtracted from adjusted gross income in order to reduce the total amount of taxes owed. A Bunch of IRS Tax Deductions and Credits You Need to Know · Child Tax Credit: · Earned Income Tax Credit (EITC): · Child and Dependent Care Credit: · Adoption. The basic standard deduction for is USD 29, for married couples filing a joint return, USD 14, for individuals, and USD 21, for heads of household.

NO – You are never allowed to deduct federal taxes on your income tax. Let's say you haven't filed taxes in two years and are now paying two years' worth of. You may deduct from federal adjusted gross income either the NC standard deduction or NC itemized deductions. For federal income tax purposes, state and local. For tax year , the minimum standard deduction is $1, Dependents with wage income may claim a standard deduction equal to the amount of their wage income. NOTE: Federal line numbers are based on tax returns. Itemized Deduction Computation. Medical and Dental Expenses. If you filed federal Schedule A and. Other deductions include student loan interest, work-related educational expenses, gambling losses, and real estate and property taxes, along with various forms. b. Mandatory deductions for U.S. citizen personal services contractors (PSCs) include U.S. Federal, State, and local income taxes, U.S. Social Security taxes. When you donate cash an IRS-qualified (c)(3) public charity, you can generally deduct up to 60% of your adjusted gross income. If you're a homeowner, you can claim the property tax deduction up to $ ($ for married filing separately). Read this complete guide before you. Standard Deduction and Itemized Deduction. As with federal income tax returns, the state of Arizona offers various credits to taxpayers. Washington state does not have a personal or corporate income tax. However, people or businesses that engage in business in Washington are subject to business. Corporations which do business in Alabama are allowed to deduct federal income taxes attributable to their Alabama income (Code of Alabama, , §(a)(2). Taxes paid or accrued by an individual during the tax year that are not directly connected with a trade or business, or with property held for the production of. Student Loan Interest Deduction. You can take a tax deduction for the interest paid on student loans that you took out for yourself, your spouse, or your. The larger the standard deduction, the less income is subject to taxation. The Tax Cuts and Jobs Act (TCJA) increased the standard deduction to $12, for. Taxpayers who itemize deductions on their federal income tax returns can deduct state and local taxes--specifically property taxes plus either income taxes or. Personal expenses · Employee business expenses (eliminated in tax law) · Federal income tax · Federal excise tax · Social Security, Medicare, FUTA, and RRTA. Both types of deductions can lower your overall income tax burden by reducing your taxable income. The Internal Revenue Service (IRS) makes the standard. It increased the standard deduction amounts for well beyond what they would have been in that year, raising the deduction from $6, to $12, for. Depending on where you live, you may be paying local or state taxes. If you itemize, you're allowed to deduct a combination of your property taxes and either. What are examples of payroll deductions? · Pre-tax deductions: Medical and dental benefits, (k) retirement plans (for federal and most state income taxes).

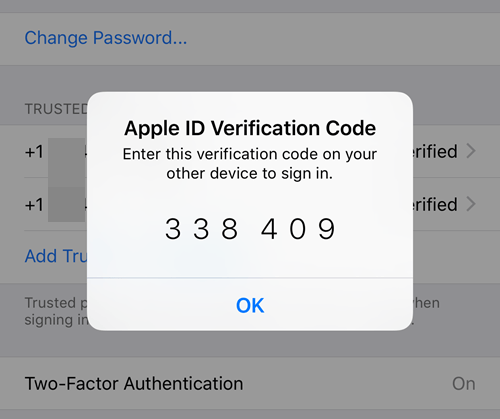

How To Get My Verification Code

What if I don't have access to my registered phone right now? We can only send the verification code to a phone number currently registered to your account. If. Quickly verify your identity", click Verify now. For desktop: Head to this page and select I cannot get my 2-step verification codes—if you don't see that. Learn how you can get your verification code after a logout from a device you've used in the past 30 days. For security reasons, it's impossible to create an account or log in to an existing one without entering the correct verification code. To get your verification code: Using a browser in privacy mode, sign in with the first account. This lets you stay signed in to both accounts at the same time. You can also generate a backup code on essaytogethertunisia.ru Write down, print or take a screenshot of this backup code. In the event that you lose your mobile device or. On a mobile device go to Settings > [your name] > Tap Password & Security > Get Verification Code. On a Mac: Go to Apple menu > System Preferences [System. Enter the verification code generated in your authentication app. Select Verify. If the QR code is not scanning from your authentication app, select Can't scan. When I tried to add my phone number to my account, the red warning finally did not pop up and my phone got an SMS verification code. So at the. What if I don't have access to my registered phone right now? We can only send the verification code to a phone number currently registered to your account. If. Quickly verify your identity", click Verify now. For desktop: Head to this page and select I cannot get my 2-step verification codes—if you don't see that. Learn how you can get your verification code after a logout from a device you've used in the past 30 days. For security reasons, it's impossible to create an account or log in to an existing one without entering the correct verification code. To get your verification code: Using a browser in privacy mode, sign in with the first account. This lets you stay signed in to both accounts at the same time. You can also generate a backup code on essaytogethertunisia.ru Write down, print or take a screenshot of this backup code. In the event that you lose your mobile device or. On a mobile device go to Settings > [your name] > Tap Password & Security > Get Verification Code. On a Mac: Go to Apple menu > System Preferences [System. Enter the verification code generated in your authentication app. Select Verify. If the QR code is not scanning from your authentication app, select Can't scan. When I tried to add my phone number to my account, the red warning finally did not pop up and my phone got an SMS verification code. So at the.

I have typed my phone number in correctly many times when it prompted me to, but whenever it said it was sending the code to my phone that I needed complete. At times, we'll send a verification code or link to your mobile number or email address to protect your account and ensure that you're the person trying to. If you have not received your code after 30 minutes, try requesting another code. If you still are unable to login, submit a request through the account. On your Android device, go to your 2-Step Verification settings for your Google Account. You may need to sign in. · Tap Set up authenticator. On some devices. If you're looking for a way to receive your email verification code via SMS, you can try AnonymSMS. This site offers free numbers that you can. On a mobile device go to Settings > [your name] > Tap Password & Security > Get Verification Code. On a Mac: Go to Apple menu > System Preferences [System. If you're not receiving the verification code via text message, you can get one via the automated on-call guidance. To use the Call me instead option: 1. Tap. If you're re-registering your phone number, you can get a code via email if you've added your email address to your account in your WhatsApp settings, during. We'll send a verification email to the new email address you entered. You'll need to click the verification button in that email within 24 hours. If you're re-registering your phone number, you can get a code via email if you've added your email address to your account in your WhatsApp settings, during. At times, we'll send a verification code or link to your mobile number or email address to protect your account and ensure that you're the person trying to. To locate the verification code you need to enter when signing in to your Nintendo Account, launch the Google Authenticator application using the smart device. "Verification codes can't be sent to this phone number at this time." I have no idea how to get to my account and there isn't much information. Trusted devices · Open System Preferences. · Click your account name. · Click Password & Security in the left panel and click Get Verification Code. Restart your mobile device · Make sure you have an Internet connection (wifi or data) on your mobile device · Verify that your notifications are turned on for the. A verification code can be sent to you via text message or email and can only be used once. However, if you are adding/updating your phone number or making a. My Authenticator verification code does not work. Authentication App 2-Step Verification codes only work when displayed in the app. Make sure you're entering. Step 3: Make sure your phone number is correct. Your verification codes may be going to different phone number. Under Account Verification in Control Centre. I have to enter the verification code from the same e-mail I'm trying to enter. my recovery phone number is the only option i have. The 6-digit code needed to sign in is displayed on the app. The app is required to set up the two-step verification feature, so you would have downloaded it.