essaytogethertunisia.ru

Market

How To Blow Cellulose Insulation Into Walls

We use blown-in cellulose for our insulation jobs for safer and more effective insulation for your homes in Spokane WA. Dense packed cellulose wall. Cellulose insulation typically comes as loose-fill fiberglass insulation. The installation process, therefore, involves using an insulation blower to blow. Upgrade existing exterior walls that are uninsulated or poorly insulated by adding blown-in insulation in the wall cavities. insulation type. Figure 1. Installing Fiberglass Batts, Dry-Blown Cellulose, and Spray Polyurethane Foam in Wall Cavities. Photograph courtesy of Cellu-Spray. It can be blown as loose-fill insulation in attic cavities, dense packed into walls and floors, or wet spray for new construction that helps increase heat. Heavy weight can damage ceilings – The heavy weight of blown-in cellulose can lead to ceiling or drywall damage. The weight of cellulose necessary to meet. Cellulose insulation includes a fire retardant and is an approved fire block component in walls. Using the product will add to the fire protection in the home. First we drill a one inch hole in all cavities in your wall, then we blow in cellulose insulation to fill the walls. We then patch your holes to match the. Spray the cellulose back and forth from the bottom, filling the wall cavity full and continue to the top. Make sure the cavity is completely full before moving. We use blown-in cellulose for our insulation jobs for safer and more effective insulation for your homes in Spokane WA. Dense packed cellulose wall. Cellulose insulation typically comes as loose-fill fiberglass insulation. The installation process, therefore, involves using an insulation blower to blow. Upgrade existing exterior walls that are uninsulated or poorly insulated by adding blown-in insulation in the wall cavities. insulation type. Figure 1. Installing Fiberglass Batts, Dry-Blown Cellulose, and Spray Polyurethane Foam in Wall Cavities. Photograph courtesy of Cellu-Spray. It can be blown as loose-fill insulation in attic cavities, dense packed into walls and floors, or wet spray for new construction that helps increase heat. Heavy weight can damage ceilings – The heavy weight of blown-in cellulose can lead to ceiling or drywall damage. The weight of cellulose necessary to meet. Cellulose insulation includes a fire retardant and is an approved fire block component in walls. Using the product will add to the fire protection in the home. First we drill a one inch hole in all cavities in your wall, then we blow in cellulose insulation to fill the walls. We then patch your holes to match the. Spray the cellulose back and forth from the bottom, filling the wall cavity full and continue to the top. Make sure the cavity is completely full before moving.

You can use a piece of rigid foam and attach it with cap nails. Installing the Blown-In Insulation. Running a loose fill machine is a two-. Blown in Cellulose Insulation · Reduces air leakage and provides more resistance to air movement than any other loose-fill insulation · Most fire-resistant. Cellulose does not contain any fiberglass which can cause irritation and rash. Typical places to use blown-in cellulose is in enclosed existing walls, open new. Our cellulose insulation is sprayed or blown into walls and attics, forming a tight thermal barrier that maximizes comfort and saves on energy costs. Essentially, we can drill holes at the top of each wall cavity, and blow cellulose insulation into the wall cavity with a special portable machine. Once the. In an open wall cavity the cellulose is blown in damp and sticks to the wall, and itself, until the wall cavity is full. After, the excess is scrubbed off using. Blown-in insulation conforms around the shape of the space without the need for invasive installation. Adding it to existing walls requires drilling holes in. Heavy weight can damage ceilings – The heavy weight of blown-in cellulose can lead to ceiling or drywall damage. The weight of cellulose necessary to meet. Dense packing cellulose into wall cavities, including previously insulated ones Once we have access, we will blow dense packed insulation into the wall. Drill and fill means that small holes are drilled into each bay of the wall then cellulose insulation is blown directly into the wall or ceiling to fill it. Insert the nozzle into the hole, snaking up the wall cavity and turn on the blower machine. The blower will start to strain when the cavity is filled. Suggested. When installing cellulose insulation via the dense pack method, one 2″ diameter access hole is drilled at the base of each stud bay in your wall (about every You can use a piece of rigid foam and attach it with cap nails. Installing the Blown-In Insulation. Running a loose fill machine is a two-. Cellulose insulation is an eco-friendly option made from recycled paper products. It's blown into wall cavities and is particularly effective for retrofitting. Densely packed pieces of cellulose are fed into the hopper of an insulation blower powered by an electric motor. · The cellulose is blown into the attic or walls. One of the top reasons for exterior paint failure, termites and structural damage to old houses is loose cellulose or fiberglass insulation blown into the. Wall spray cellulose is also a GREEN product with no toxins to harm you or the installers. Sprayed cellulose does not settle in the walls and it does not itch. The cellulose wall spray is applied directly into the wall cavities, against sheathing or foundation, and fills the area completely to effectively air seal and. insulating material into your wall or roof cavities. For example, blown-in cellulose insulation looks noticeably different to blown-in fibreglass insulation. Cellulose is blown in and can be installed directly into your wall or attic cavity using a specialty blower machine. Using a wet mix of water and the cellulose.

Best Pans For The Money

Like stainless steel, there are many variants of what nonstick pan bases are made of. From aluminum, stainless steel, copper, and other metals, you'll want to. cash payment); list icon Douglas: Chevron - Pan American Ave, Douglas, AZ (no fee for cash payment); list icon Flagstaff: Bashas - S Woodlands. Tramontina's inch skillet takes the top spot for the best budget nonstick fry pan. You can find cheaper pans, but none of them match Tramontina's excellent. pan for more of a rectangular presentation or split the dough into two loaf pans. I do not recommend an angel food cake pan; the sugar/butter mixture will. Best Free Checking · Student Loans · Personal Loans · Insurance · Car insurance Total Cash (mrq). M. Total Debt/Equity (mrq). %. Levered Free Cash. Shop Best Nonstick Cookware Sellers ; HAPTIQ 8'' Fry Pan · $ ; CLASSIC 3-Piece Skillet Set · $ · $ ; CS+ 2-Piece Fry Pan Set · $ · $ Discover the best Kitchen Cookware Sets in Best Sellers. Find the top most popular items in Amazon Kitchen & Dining Best Sellers. It's expensive — $ USD (but considering it's multi-functional, it does save money if replacing other cookware) Perhaps the best part about the Always Pan? Save money and cabinet space with products designed to do everything and more. best pan there is. From oven-safety to a longer-lasting nonstick ceramic. Like stainless steel, there are many variants of what nonstick pan bases are made of. From aluminum, stainless steel, copper, and other metals, you'll want to. cash payment); list icon Douglas: Chevron - Pan American Ave, Douglas, AZ (no fee for cash payment); list icon Flagstaff: Bashas - S Woodlands. Tramontina's inch skillet takes the top spot for the best budget nonstick fry pan. You can find cheaper pans, but none of them match Tramontina's excellent. pan for more of a rectangular presentation or split the dough into two loaf pans. I do not recommend an angel food cake pan; the sugar/butter mixture will. Best Free Checking · Student Loans · Personal Loans · Insurance · Car insurance Total Cash (mrq). M. Total Debt/Equity (mrq). %. Levered Free Cash. Shop Best Nonstick Cookware Sellers ; HAPTIQ 8'' Fry Pan · $ ; CLASSIC 3-Piece Skillet Set · $ · $ ; CS+ 2-Piece Fry Pan Set · $ · $ Discover the best Kitchen Cookware Sets in Best Sellers. Find the top most popular items in Amazon Kitchen & Dining Best Sellers. It's expensive — $ USD (but considering it's multi-functional, it does save money if replacing other cookware) Perhaps the best part about the Always Pan? Save money and cabinet space with products designed to do everything and more. best pan there is. From oven-safety to a longer-lasting nonstick ceramic.

"Best pan on the market. Very heavy duty. Heats evenly and if used properly I would definitely recommend, it's worth the money." — Lana P. Read all. I only recommend ALL Clad copper core. They are layered metal that are fused together and gives you the best pan for the money. They are made in. Arrange the dough balls in a Bundt pan, then top it all with a buttery brown sugar sauce before baking. Invert it onto a serving plate, then drizzle with. The best baby monitor, pet camera made by Wyze. A great add-on to your home positive-insights Value for money. Functionality Motion detection. Sound. Most western cooking wants a pan with even steady heat over the entire cooking surface. Thick materials, copper, cast iron, thick almuminum. pan for more of a rectangular presentation or split the dough into two loaf pans. I do not recommend an angel food cake pan; the sugar/butter mixture will. Best Sellers (9) ; HexClad Hybrid Perfect Pots & Pans Set (12PC) · $ $ · $ ($ value) · 30% Savings ; Hybrid Fry Pan Set with Lids, 6pc · $ $ Okay, now back to the freezer meals info and recipes. MY TOP 15 ALL-TIME FAVORITE FREEZER MEAL RECIPES. lasagna in pan. 1. Homemade Easy Lasagna. There is no one "best" cookware, but stainless steel is a popular choice amongst pros for their durability. Your own cooking habits and preferences will. Discover the best Kitchen Cookware Sets in Best Sellers. Find the top most popular items in Amazon Kitchen & Dining Best Sellers. I Tried 8 Nonstick Skillets That Cost $25 or Less. One Blew Me Away. ; Farberware Commercial Nonstick Frying Pan at Amazon. Farberware Commercial Nonstick Frying. Listen, for me it's the best pan in the world, I wouldn't use any other pan. Money. Why? I'm going to show you now. Baking paper is a problem because. Check out our guide below to learn why the All-Clad D3 Stainless Three-Ply Bonded Nonstick Piece Cookware Set is our pick for the best overall nonstick. I've several Le Creuset casserole dishes (the enamelled iron ones which can be used in the oven and on the hob). Pros are they are good looking. These Calphalon Premier Space-Saving cookware sets are the best space-saving option. Whether you're the experienced chef at home or learning, Select by. Quality finishes make our materials easy to clean. Best Seller. Popular The pots and pans themselves are great. Bottom Line Yes, I would recommend to. (A drip pan that comes complete with a spout is going to be your best pick.) Empty the filter. Make sure you include your oil filter in your efforts! Start. Stainless steel. A popular choice because it's strong, hard, non-corrosive and affordable, but stainless steel cookware doesn't conduct heat well, so it's. From how they perform to how long they'll last, we've got the goods on whether they're value for your hard-earned money. Best frying pans under $ These.

Unsecured Debt Meaning

For example, most debts for services and some credit card debts are “unsecured”. Priority Debt - A debt entitled to priority payment ahead of most other debts. Secured debts are loans or lines of credit that have some form of collateral backing them up and where the borrower usually puts some asset as a surety. Unsecured debt refers to any type of debt or general obligation that is not protected by a guarantor, or collateralized by a lien on specific assets of the. An unsecured note is basically a debt instrument or a loan that is not secured (covered by collateral) by the assets of the issuer of the note. Unsecured loans are not backed by any security and include loans like Credit Cards, Student Loans or Personal Loans. Lenders take more risk in this type of. Personal loans. Unsecured debts include loans that you obtain from a person, bank or other financial institution (excepting a mortgage or other loan secured by. Unsecured debt isn't backed by collateral, so lenders might rely more heavily on credit scores and credit history to make lending decisions. That's one reason. Unsecured debt is unique in that there is no collateral backing it, meaning property can't be seized if you default on paying the loan or balance. debt for which the lender has no right to the property or other assets of the borrower if the debt is not paid. For example, most debts for services and some credit card debts are “unsecured”. Priority Debt - A debt entitled to priority payment ahead of most other debts. Secured debts are loans or lines of credit that have some form of collateral backing them up and where the borrower usually puts some asset as a surety. Unsecured debt refers to any type of debt or general obligation that is not protected by a guarantor, or collateralized by a lien on specific assets of the. An unsecured note is basically a debt instrument or a loan that is not secured (covered by collateral) by the assets of the issuer of the note. Unsecured loans are not backed by any security and include loans like Credit Cards, Student Loans or Personal Loans. Lenders take more risk in this type of. Personal loans. Unsecured debts include loans that you obtain from a person, bank or other financial institution (excepting a mortgage or other loan secured by. Unsecured debt isn't backed by collateral, so lenders might rely more heavily on credit scores and credit history to make lending decisions. That's one reason. Unsecured debt is unique in that there is no collateral backing it, meaning property can't be seized if you default on paying the loan or balance. debt for which the lender has no right to the property or other assets of the borrower if the debt is not paid.

An unsecured debt is a loan that is not backed up by collateral, such as property or money. Meaning of Unsecured Debt: Unsecured debt has no insurance or no collateral backing. It requires no security, as the name infers. Assuming that the borrower. Unlike mortgages that are secured against a specific house or a vehicle loan that is secured against a specific vehicle, unsecured loans are not related to any. An unsecured loan is a type of loan that doesn't require a company to put up any company collateral as security. The loan amount is based on the borrower's. An unsecured debt does not have any major assets – such as a property – linked to it. This means your house or a car, for example, cannot be taken by creditors. definition of secured debt and how it differs from unsecured debt. Secured debt is backed by collateral, or assets that you have in your possession. definition of secured debt and how it differs from unsecured debt. Secured debt is backed by collateral, or assets that you have in your possession. As opposed to secured debt, which is backed by a tangible piece of property, unsecured debts are not secured by the property. This means if you stop paying on. An unsecured loan has no guarantor or collateral. This means that if there's a default, the lender cannot immediately seize assets and sell them. In an unsecured loan, a lender provides money to a borrower without any legal claim to the borrower's assets in case of default. An unsecured loan requires no collateral, though you are still charged interest and sometimes fees. Student loans, personal loans and credit cards are all. An unsecured debt is an obligation or debt that doesn't have specific property, like your house or car, serving as collateral for payment of the debt. a loan for which the lender has no right to the property or other assets of the borrower if the money is not paid back. Unsecured loans are also known as personal loans. This involves borrowing money from a bank or other lender. You agree to make regular payments until the loan. Unsecured debt is a type of borrowing that is not backed by collateral or a specific asset, meaning that lenders cannot seize property or assets if the. Unsecured Debt Definition An unsecured debt is not secured by collateral. Therefore, we refer to the creditor as an unsecured creditor. Examples of unsecured. A secured transaction is a transaction where a security interest exists for the creditor or lender, which is collateral that guarantees a loan will be paid. Unsecured Subordinated Debt means Subordinated Debt that does not have the benefit of any Lien or other credit support provided by any Obligor. Sample. This most commonly means credit card debt, but can also refer to items like personal loans and medical debt. Unsecured debt creates less stress and fewer. A car loan is also a secured debt. In addition to these voluntary security agreements, there are some types of secured debts that you might not have agreed to.

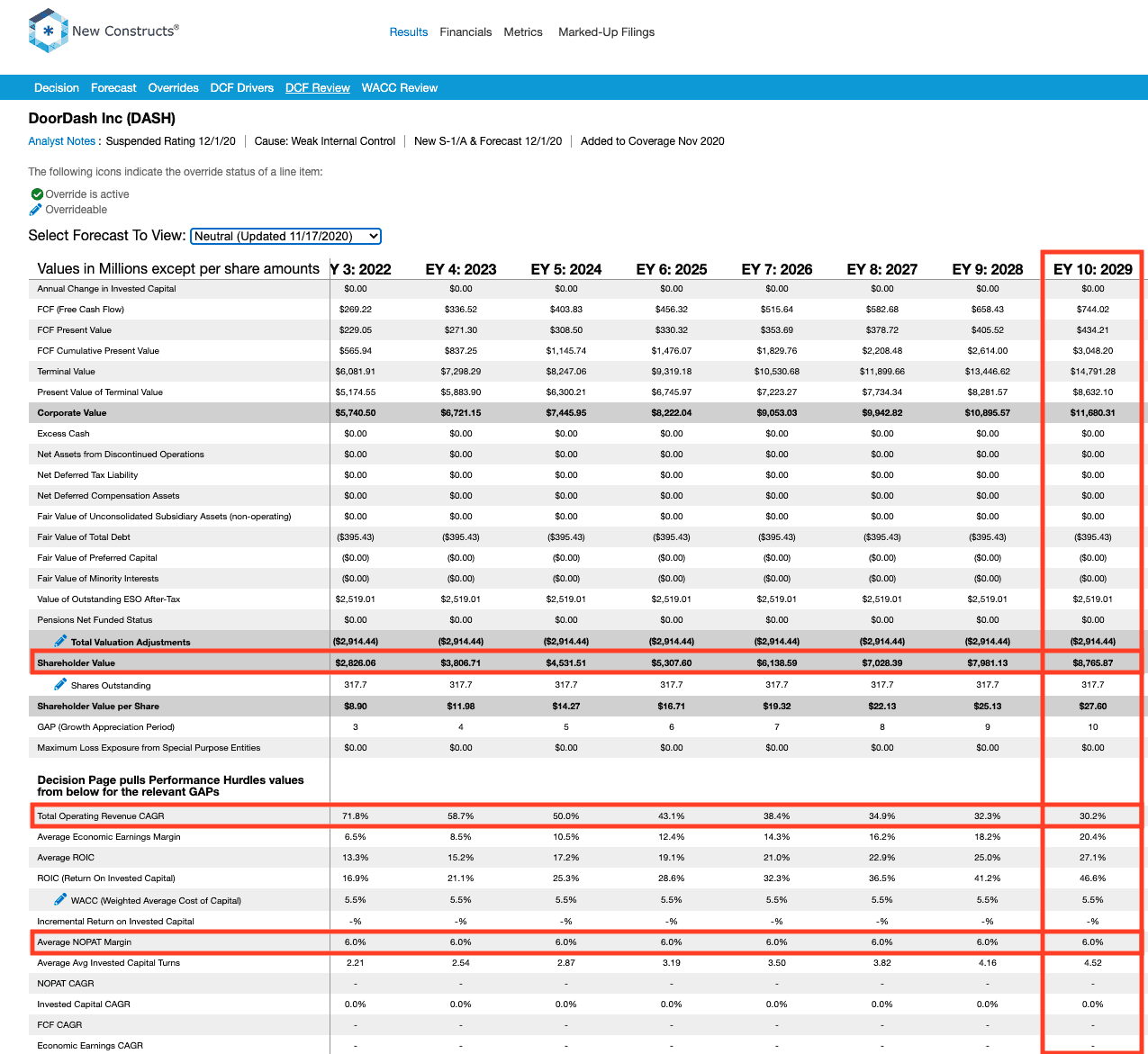

Door Dash Valuation

DoorDash is a food delivery platform that connects customers with local and national business. "DoorDash valued at $71 billion in blockbuster market debut". Reuters "Airbnb, DoorDash Aim for Higher-Than-Expected Valuations Ahead of Debuts". "DoorDash valued at $71 billion in blockbuster market debut". Reuters "Airbnb, DoorDash Aim for Higher-Than-Expected Valuations Ahead of Debuts". Interactive chart of historical net worth (market cap) for DoorDash (DASH) over the last 10 years DoorDash net worth as of August 30, is $B. The amounts included here represent the stock-based compensation associated with the excess amount of the grant-date fair value over the A value. DoorDash, enables small businesses to provide its customers with local delivery services Valuation: $ round. Feb , investor investor investor investor. Valuation Measures. Current Quarterly Annual. As of 8/23/ Market Cap. B. Enterprise Value. B. Trailing P/E. Forward P/E. PEG Ratio . Funding, Valuation & Revenue. 12 Fundings. DoorDash has raised $B over 12 rounds. DoorDash's latest funding round was a IPO for $3,M on December 8. For a ~$33 food order, DoorDash keeps ~$5 in revenue, a take rate of 15%. The remaining ~$28 is divided between merchants and the Dasher. The. DoorDash is a food delivery platform that connects customers with local and national business. "DoorDash valued at $71 billion in blockbuster market debut". Reuters "Airbnb, DoorDash Aim for Higher-Than-Expected Valuations Ahead of Debuts". "DoorDash valued at $71 billion in blockbuster market debut". Reuters "Airbnb, DoorDash Aim for Higher-Than-Expected Valuations Ahead of Debuts". Interactive chart of historical net worth (market cap) for DoorDash (DASH) over the last 10 years DoorDash net worth as of August 30, is $B. The amounts included here represent the stock-based compensation associated with the excess amount of the grant-date fair value over the A value. DoorDash, enables small businesses to provide its customers with local delivery services Valuation: $ round. Feb , investor investor investor investor. Valuation Measures. Current Quarterly Annual. As of 8/23/ Market Cap. B. Enterprise Value. B. Trailing P/E. Forward P/E. PEG Ratio . Funding, Valuation & Revenue. 12 Fundings. DoorDash has raised $B over 12 rounds. DoorDash's latest funding round was a IPO for $3,M on December 8. For a ~$33 food order, DoorDash keeps ~$5 in revenue, a take rate of 15%. The remaining ~$28 is divided between merchants and the Dasher. The.

Detailed statistics for DoorDash, Inc. (DASH) stock, including valuation metrics, financial numbers, share information and more. See the latest DoorDash Inc Ordinary Shares - Class A stock price (DASH:XNAS), related news, valuation, dividends and more to help you make your investing. DoorDash has risen over 20% since late April, with it reporting better-than-expected Q1 results and raising guidance. DoorDash has raised a total of $B in funding over 13 rounds. Their latest funding was raised on Jun 11, from a Series H round. DoorDash is funded by 32 investors. Durable Capital Partners and Kohlberg Kravis Roberts are the most recent investors. The intrinsic value of one DASH stock under the Base Case scenario is USD. Compared to the current market price of USD, DoorDash Inc is Overvalued. Find out all the key statistics for DoorDash, Inc. (DASH), including valuation measures, fiscal year financial statistics, trading record, share statistics. The amounts included here represent the stock-based compensation associated with the excess amount of the grant-date fair value over the A value. What is the DCF value of one DASH stock? Estimated DCF Value of one DASH stock is USD. Compared to the current market price of USD, the stock is. As of , the Fair Value of DoorDash Inc (DASH) is USD. This value is based on the Peter Lynch's Fair Value formula. DoorDash Inc (NASDAQ:DASH) Intrinsic Valuation. Check if DASH is overvalued or undervalued under the bear, base, and bull scenarios of the company's future. DASH | Complete DoorDash Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Research DoorDash's (Nasdaq:DASH) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance and more. DoorDash's net worth. DoorDash's valuation is the process of determining the intrinsic value of its stock by analyzing various financial and operational factors. Latest Valuation (): $ BN. Description. DoorDash is an on-demand prepared food delivery service. The company's application offers wide range. In depth view into DoorDash Enterprise Value including historical data from , charts and stats. DASH (DoorDash) GF Value as of today (August 14, ) is $ GF Value explanation, calculation, historical data and more. Valuation Measures. Current Quarterly Annual. As of 9/3/ Market Cap. B. Enterprise Value. B. Trailing P/E. Forward P/E. PEG Ratio (5yr. The Discounted Cash Flow (DCF) valuation of DoorDash Inc (DASH) is () USD. With the latest stock price at USD, the upside of DoorDash Inc (DASH). DASH | Complete DoorDash Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview.

How To Know Scammer Number

Let your mobile carrier know right away if you think that your phone number may be hacked or compromised. Your provider can help you regain access to your phone. Network-level protection has been added to stop the increasingly common “Neighborhood Spoofing” and prevent hijacked numbers (where scammers temporarily match. How To Identify a Scammer on the Phone: 10 Warning Signs · You receive an unsolicited phone call. · You're offered a too-good-to-be-true deal or giveaway. Scammers typically use robot dialers, which dial every possible number. They can detect when someone answers, so they mark those answered calls as real numbers. You're then provided with a new card number and asked to transfer your funds. Scammers may pose as businesses or people you know — like your bank, utility. It is a scam! Scammers may use legitimate names and phone numbers of Social Security Administration (SSA) or SSA Office of the Inspector General (OIG). Many mobile phones include features built into the phone that will identify suspected spam calls or block calls from specific numbers. For some you may have to. Scam calls and texts aim to mislead people into revealing some personal or sensitive information to the scammer. There are several ways to identify scam calls. Copy the phone number to your clip board. Paste in Google. Now you know where they are. If on a cell phone try this usually there is information. Let your mobile carrier know right away if you think that your phone number may be hacked or compromised. Your provider can help you regain access to your phone. Network-level protection has been added to stop the increasingly common “Neighborhood Spoofing” and prevent hijacked numbers (where scammers temporarily match. How To Identify a Scammer on the Phone: 10 Warning Signs · You receive an unsolicited phone call. · You're offered a too-good-to-be-true deal or giveaway. Scammers typically use robot dialers, which dial every possible number. They can detect when someone answers, so they mark those answered calls as real numbers. You're then provided with a new card number and asked to transfer your funds. Scammers may pose as businesses or people you know — like your bank, utility. It is a scam! Scammers may use legitimate names and phone numbers of Social Security Administration (SSA) or SSA Office of the Inspector General (OIG). Many mobile phones include features built into the phone that will identify suspected spam calls or block calls from specific numbers. For some you may have to. Scam calls and texts aim to mislead people into revealing some personal or sensitive information to the scammer. There are several ways to identify scam calls. Copy the phone number to your clip board. Paste in Google. Now you know where they are. If on a cell phone try this usually there is information.

Never give your bank account, credit card or Social Security number to someone you don't know who calls you on the phone. The scammer endorses the check. What number does Social Security call from? Social Security's phone number is However, it's easy for scammers to show any number on a Caller ID. Never provide anyone with your Google Voice verification code. Upon receiving this code, the scammer can use your phone number to create a Google Voice account. Scammers can spoof phone numbers from your local area code or a number that you recognize. When they call, you might think it's your mother or brother. To check if a phone number belongs to a scammer, you can use online tools such as “,”,_ or 8 to run a reverse phone lookup. These tools can. Scammers may know which bank or credit union you're using. They'll fake the number they're calling from to make it look like they're from your bank. Or they. Best practice is not to answer calls from suspicious phone numbers. Scammers also know how to “spoof” the numbers of respected businesses or other phone numbers. It's important to report scam numbers to the proper authorities so the scammer doesn't claim any more victims. This wikiHow article will teach you how to report. Check phone numbers closely. Scam artists spoof calls to make them appear to be from a local telephone number. · Hang up. If you answer a call that seems. r/ScamNumbers: A community dedicated to sharing scam numbers for prank calls and raising awareness about scammers. Discover active scam numbers. The scammers might have Googled your info. It's easy to get someone's phone number and other personal information from data brokers. Scammers can manipulate caller ID so that it appears to be an “official” call or a call from your city or town. Only answer calls when you recognize the number. Another way to determine if a call or text is spam is to look for specific patterns. For calls, look for unknown numbers, calls from numbers that have been. Do not trust your Caller ID. Scammers can fake the name and number that appears on your caller ID, making it look like the call is from the government or. Phone number spoofing is a popular way for scammers and telemarketers to contact you with a false caller ID. Read on to learn about how to avoid it. Our Scam Phone Number Lookup (SPNL) is a Reverse Phone Lookup for Scams where you can report suspicious phone numbers. When you submit information to us, we. If someone outside your contact list calls you, or you call them, that phone number is sent to Google to help identify its business Caller ID name or determine. Google the number and see what comes up; if it's not the company's number, call the company to check when they last wanted to contact you over the phone. Scammers will often spoof the number so it begins with your own area code to look like the call is local or coming from someone you may know, even though it's. Scammers might also initiate contact by displaying fake error messages on websites you visit, displaying support numbers and enticing you to call. They may also.

Capital Gain On Selling Your Home

To calculate the capital gain, you deduct the basis, costs incurred during purchase, improvement costs, selling costs, and the exemption. In our example, the. Homeowners who have owned their homes for at least two years are entitled to a capital gains tax exemption when they sell. For married couples that file jointly. Gains on the sale of personal or investment property held for more than one year are taxed at favorable capital gains rates of 0%, 15%, or 20%, plus a %. my primary residence in the eyes of the CRA? Will buying my next home first cause me to incur capital gains on the sale? Upvote 0. Downvote 8. The biggest concern when selling property is capital gains taxes. A capital gain is the difference between the “basis” in property and its selling price. If You Sell Together. If you and your spouse sell your house at the time you're getting divorced, the capital gains tax applies. But you're entitled to exclude. In that case, you don't qualify for the exclusion and gains are considered short term, meaning they'll be taxed at federal ordinary income rates—running as high. Marriage and Divorce and the Ownership and Use Test. Married couples filing jointly may exclude up to $, in gain, provided: Separate residences. If each. Your tax rate is 15% on long-term capital gains if you're a single filer earning between $44, to $,, married filing jointly earning between $89, to. To calculate the capital gain, you deduct the basis, costs incurred during purchase, improvement costs, selling costs, and the exemption. In our example, the. Homeowners who have owned their homes for at least two years are entitled to a capital gains tax exemption when they sell. For married couples that file jointly. Gains on the sale of personal or investment property held for more than one year are taxed at favorable capital gains rates of 0%, 15%, or 20%, plus a %. my primary residence in the eyes of the CRA? Will buying my next home first cause me to incur capital gains on the sale? Upvote 0. Downvote 8. The biggest concern when selling property is capital gains taxes. A capital gain is the difference between the “basis” in property and its selling price. If You Sell Together. If you and your spouse sell your house at the time you're getting divorced, the capital gains tax applies. But you're entitled to exclude. In that case, you don't qualify for the exclusion and gains are considered short term, meaning they'll be taxed at federal ordinary income rates—running as high. Marriage and Divorce and the Ownership and Use Test. Married couples filing jointly may exclude up to $, in gain, provided: Separate residences. If each. Your tax rate is 15% on long-term capital gains if you're a single filer earning between $44, to $,, married filing jointly earning between $89, to.

The good news is you won't owe this tax until you actually sell the property. Final Thoughts on the Principal Residence Exemption. If you're a Canadian, the. First, you can consider setting up a fund and saving for the capital gain payment in advance – years before you end up selling or otherwise disposing of the. And yes, these profits are taxed as income. But here's the good news: You can exclude up to $, of the capital gains from the sale if you're single, and. You can exclude up to $k of gains ($k if married filing jointly) if you have owned & lived in the home as your primary residence for any. Understanding Capital Gains Tax: Capital gains taxes are fees that real estate investors must pay after selling a property. They are calculated based on the. If your profit from the sale is more than that, the excess is reported as a capital gain. Tell us about your home and the sale, and we'll determine what, if. But if you inherit property and sell it for a profit without it being your primary residence, then the rules of capital gains tax apply. New capital gains. Then, if you qualify for an exemption, subtract the amount. What's left is the amount of money you 're going to need to pay tax on capital gains. Property Taxes. When you sell your primary residence, you can make up to $, in profit if you're a single owner, twice that if you're married, and not owe any capital. If you've owned the property for more than one year and never rented it out, you'll owe federal capital gains tax at the lower rates for long-term capital gains. Luckily, there is a tax provision known as the "Section Exclusion" that can help you save on taxes following a home sale. In simple terms, this capital. Using the capital gain calculator will help you determine the total tax you need to pay on any profit you've earned through the sale of an asset. The biggest concern when selling property is capital gains taxes. A capital gain is the difference between the “basis” in property and its selling price. If you meet the ownership and use tests, the sale of your home qualifies for exclusion of $, gain ($, if married filing a joint return). This. Capital gains tax, often a topic of interest among real estate enthusiasts, is a tax levied on the profit you make when you sell an asset for more than you paid. Most homes will be sold with a profit. This profit is referred to as a capital gain. If you are selling your main home or personal residence, you may be. You do not pay Capital Gains Tax when you sell (or 'dispose of') your home if all of the following apply: If all these apply you will automatically get a tax. All owners of US real property must pay income tax on the gain on the sale of that property, regardless of where they normally reside or pay tax. If the house is in YOUR name, and it is NOT your primary residence, then you are liable for Capital Gains on the property. Now. When you sell your home for more than what you paid for it, the profit you make is considered a capital gain and may be subject to taxation. Understanding how.

Fed Rate Update

% – Effective as of: September 10, What is Prime Rate? The Prime Rate is the interest rate that banks use as a basis to set rates for different. BEA's Annual Update of GDP Statistics Starts September National and Personal saving was $ billion and the personal saving rate—personal. The current Federal Reserve interest rate was raised a quarter-point to % to % in July, which is at its highest level in 22 years. Following a brief. Effective Federal Funds Rate is at %, compared to % the previous market day and % last year. This is higher than the long term average of %. We don't see the Federal Reserve cutting policy rates as sharply as markets expect and go underweight U.S. short-dated Treasuries. We prefer medium-term. The federal funds rate is the target interest rate set by the Fed at which editorial policies. Updated June 18, Reviewed by. Erika Rasure. Monthly Update. On December 15, , the FDIC Board of Directors approved a Final Rule - PDF (PDF) making certain revisions to the interest rate. The composite rate for I bonds issued from May through October is %. Here's how we got that rate: Fixed rate, %. Semiannual (1/2 year). Fed Governor Waller backs interest rate cut at September meeting, open to larger move Nobel laureate Joseph Stiglitz wants the Fed to deliver a big interest. % – Effective as of: September 10, What is Prime Rate? The Prime Rate is the interest rate that banks use as a basis to set rates for different. BEA's Annual Update of GDP Statistics Starts September National and Personal saving was $ billion and the personal saving rate—personal. The current Federal Reserve interest rate was raised a quarter-point to % to % in July, which is at its highest level in 22 years. Following a brief. Effective Federal Funds Rate is at %, compared to % the previous market day and % last year. This is higher than the long term average of %. We don't see the Federal Reserve cutting policy rates as sharply as markets expect and go underweight U.S. short-dated Treasuries. We prefer medium-term. The federal funds rate is the target interest rate set by the Fed at which editorial policies. Updated June 18, Reviewed by. Erika Rasure. Monthly Update. On December 15, , the FDIC Board of Directors approved a Final Rule - PDF (PDF) making certain revisions to the interest rate. The composite rate for I bonds issued from May through October is %. Here's how we got that rate: Fixed rate, %. Semiannual (1/2 year). Fed Governor Waller backs interest rate cut at September meeting, open to larger move Nobel laureate Joseph Stiglitz wants the Fed to deliver a big interest.

interest rates will be on September 18, Prime Rate Definition. The U.S. Prime Rate is a commonly used, short-term interest rate in the banking system of. On Wednesday, July 31, , the Federal Open Market Committee (FOMC) voted unanimously to hold the federal funds rate at a target range of. The FOMC raised interest rates to %–% at the July meeting, marking 11 rate hikes in a cycle aimed at curbing high inflation. Since then, rates have. The minimum bid rate refers to the minimum interest rate at which counterparties may place their bids. Technical updates to this site. Corporate Policies. As expected, the Federal Reserve kept the target range for the federal funds rate at % to % at its July meeting, but it opened the door to cutting rates. Canada Student Loan Interest Suspension Update. Effective April , the Government of Canada has suspended the accumulation of interest on Canada Student. The composite rate for I bonds issued from May through October is %. Here's how we got that rate: Fixed rate, %. Semiannual (1/2 year). See the mortgage rate a typical consumer might see in the most recent Primary Mortgage Market Survey, updated weekly. The PMMS is focused on conventional. interest rates by category ; Underpayment (corporate and non-corporate), 8%, 8% ; GATT (part of a corporate overpayment exceeding $10,), %, % ; Large. The data updated each day is the data effective as of that day. Federal Funds Effective Rate · FOMC Summary of Economic Projections for the Fed Funds Rate. In response, the Federal Reserve started increasing interest rates to cool the pace of rising prices, hiking its benchmark rate 11 times between March and. United States Federal Reserve Interest Rate Decision ; Nov 07, ; Sep 18, , %. On Wednesday, July 31, , the Federal Open Market Committee (FOMC) voted unanimously to hold the federal funds rate at a target range of. Fed's Bostic downplays recession fears, says interest-rate cut 'is coming' For the best essaytogethertunisia.ru experience, please update to a modern browser. And the Fed's rate hikes seem to be working—in June , year-over-year inflation was %. Now, it's 3%. While inflation has declined, it still remains above. Jerome H. Powell indicated the Federal Reserve will begin to cut interest rates in September, but stopped short of stating how large that move might be. Page 1. (Updated: Monthly) Measuring the Natural Rate of Interest (Updated: Quarterly) Multivariate Core Trend Inflation (Updated: Monthly) The New York Fed DSGE Model. The composite rate for I bonds issued from May through October is %. Here's how we got that rate: Fixed rate, %. Semiannual (1/2 year). Federal Reserve's posts ; 4. 6. 15 ; 6. 7. 15 ; 5. 5. 25 ; 1. 5 ; 8. Late last year, the Fed was widely expected to cut the benchmark federal-funds rate in as many as six times. But at the conclusion of its June 11 and

Treehouse Tech Degree Review

All of its learning programs are self-paced. Its techdegree programs focus on beginners or someone wanting to start a new career. Its interface is a little old-. They provide Techdegree which is a Bootcamp-tier program including portfolios of curated projects, Workshops, Quizzes, and access to the exclusive content. Its interface is a little old-fashioned and not the most intuitive, and its course quality is a little out of date, and many users have been left unsatisfied by. We feel like we're on to something. Our first cohort of Techdegree students, who completed the program in , had an 80 percent placement rate. Two new. The Techdegree is designed to significantly accelerate a student's job readiness for technical careers. We believe that products like Techdegree are going to be. Treehouse has an affordable coding “Bootcamp” or training program known as Techdegree. This is offered to people who want to learn how to design and code. It. The method of teaching Treehouse uses is really great. They have high quality videos and the teachers for the courses seem friendly and helpful. Treehouse is an online technology school that offers beginner to advanced courses in web design, web development, mobile development and game development taught. We think a Treehouse Techdegree is worth it. Using a combination of courses, real-world projects and code reviews, you'll master specific disciplines such as. All of its learning programs are self-paced. Its techdegree programs focus on beginners or someone wanting to start a new career. Its interface is a little old-. They provide Techdegree which is a Bootcamp-tier program including portfolios of curated projects, Workshops, Quizzes, and access to the exclusive content. Its interface is a little old-fashioned and not the most intuitive, and its course quality is a little out of date, and many users have been left unsatisfied by. We feel like we're on to something. Our first cohort of Techdegree students, who completed the program in , had an 80 percent placement rate. Two new. The Techdegree is designed to significantly accelerate a student's job readiness for technical careers. We believe that products like Techdegree are going to be. Treehouse has an affordable coding “Bootcamp” or training program known as Techdegree. This is offered to people who want to learn how to design and code. It. The method of teaching Treehouse uses is really great. They have high quality videos and the teachers for the courses seem friendly and helpful. Treehouse is an online technology school that offers beginner to advanced courses in web design, web development, mobile development and game development taught. We think a Treehouse Techdegree is worth it. Using a combination of courses, real-world projects and code reviews, you'll master specific disciplines such as.

It's an educational program that employs programming projects, mentorship opportunities, code reviews, and a final proctored exam. Treehouse is an online learning platform that hosts courses related to technology and software. Primarily targeting developers, it offers over courses on. Techdegree courses explain. | By Treehouse | Javascript is everywhere and being used in all phases of development from software to hardware. With a free 7-day trial, you can start your learning journey today and unlock the door to opportunity. Treehouse also offers Techdegree programs, career advice. Students rated Treehouse out of five stars. Read student reviews and learn about the courses offered by Treehouse, including cost, program length. My Teamtreehouse techdegree project 7. In this project we have to make a Flikr image search single page app with React, the well known front-end framework. A sample repo for the Continuous Integration with Jenkins course on Treehouse. This one includes a Jenkinsfile. Yes, Team Treehouse is worth it, especially considering the quality and variety of courses this online learning platform provides. The vast majority of Team. Treehouse's certificates and badges hold similar weight in the tech industry. They are respected for demonstrating a learner's dedication to developing coding. Last week, I invited on 3 graduates to review Treehouse's front end techdegree reviews, and constructive criticism for the program. If. I finished my third Techdegree with Treehouse: the Python Developpement Techdegree. It comes in addition to the two other Techdegrees I already have. Treehouse is a great starting point if you're looking to build a strong foundation in web development. The tech degree also includes building some great. How I learned to code websites · Starting Treehouse Techdegree Full Stack Javascript · Is The Treehouse Techdegree Worth it? · Treehouse Techdegree. Treehouse Techdegree · Real life projects – This is the best part of this plan. · Peer Review – Don't worry if you have done something wrong within the project. You get well-structured information and constant feedback on your code. However, it is your choice whether you are ready to pay almost $ for a Tech Degree. Techdegree is an online bootcamp-style program that guides you through a full curriculum of Treehouse learning. Start Your Techdegree. Category: Code-Learning Platform. Description; Reviews (0). Description. Over courses available; Tech degrees available for advanced. Treehouse Techdegree is an alternative to traditional schooling and certification programs. Upon completion of a Treehouse Techdegree you will have a. There are some complaints here and there, but the general overall consensus is that TreeHouse is a good platform to learn coding and web development. DataCamp. Since the Data Analysis Techdegree curriculum is a selected compilation of courses from the Treehouse library, it faces the same content gaps. But the Treehouse.

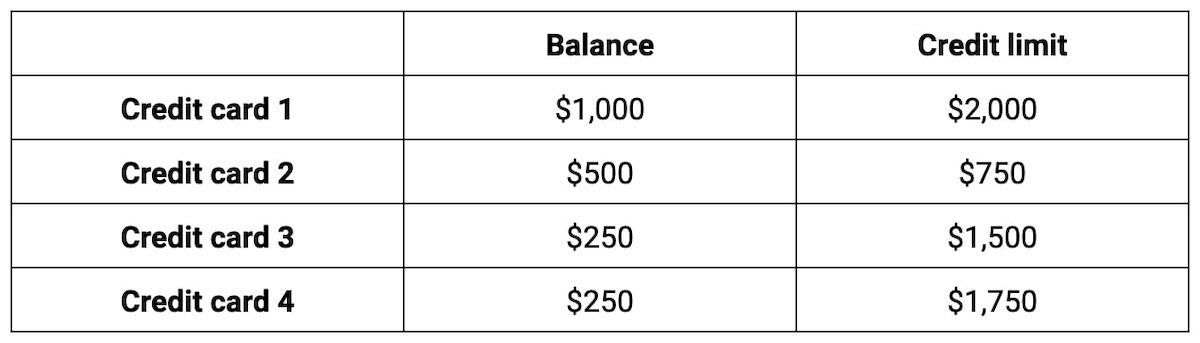

How To Calculate 30 Of Credit Card Balance

Credit Card Calculator ; Credit card balance ; Interest rate ; How do you plan to payoff? Pay a certain amount. pay per month. or use Interest + 1% of Balance, 2%. Your credit card balances should stay below 30% of your credit limit. Paying How to calculate your debt-to-income ratio (DTI). Calculating your DTI. Your total credit utilization ratio is the sum of all your balances, divided by the sum of your cards' credit limits. You can calculate your monthly credit card payment by multiplying the monthly interest rate by the outstanding balance. The monthly rate can be obtained by. To calculate your credit utilization ratio, you need to tally up all of your credit accounts. First, add up all the outstanding balances, then add up the credit. What categories are considered when calculating my FICO Score? · Payment history (35%) · Amounts owed (30%) · Length of credit history (15%) · Credit mix (10%) · New. Then, multiply by to get the percentage. For example, if you carried the average credit card balance of $6, on your card(s) and also had the average. Your monthly payment is calculated as the percent of your current outstanding balance you entered. Your monthly payment will decrease as your balance is paid. When you surpass the 30% limit on one credit card, try to balance it with your other cards. Either not use them till you repay the outstanding or use the least. Credit Card Calculator ; Credit card balance ; Interest rate ; How do you plan to payoff? Pay a certain amount. pay per month. or use Interest + 1% of Balance, 2%. Your credit card balances should stay below 30% of your credit limit. Paying How to calculate your debt-to-income ratio (DTI). Calculating your DTI. Your total credit utilization ratio is the sum of all your balances, divided by the sum of your cards' credit limits. You can calculate your monthly credit card payment by multiplying the monthly interest rate by the outstanding balance. The monthly rate can be obtained by. To calculate your credit utilization ratio, you need to tally up all of your credit accounts. First, add up all the outstanding balances, then add up the credit. What categories are considered when calculating my FICO Score? · Payment history (35%) · Amounts owed (30%) · Length of credit history (15%) · Credit mix (10%) · New. Then, multiply by to get the percentage. For example, if you carried the average credit card balance of $6, on your card(s) and also had the average. Your monthly payment is calculated as the percent of your current outstanding balance you entered. Your monthly payment will decrease as your balance is paid. When you surpass the 30% limit on one credit card, try to balance it with your other cards. Either not use them till you repay the outstanding or use the least.

I'm hearing that 30% is a good credit utilization ratio but I'm Last week I had one credit card report a $1 balance, and none of my. There is usually a dollar amount for your minimum monthly payment, and it may be written like, "$35 or 2% of your balance plus fees, whichever is greater." Each. You can determine the ratio by dividing your total credit card statement balance, by your total credit card limit. For example, if your credit card bill is $ You can calculate your Credit utilization by taking the total of your revolving debt and dividing it by the total amount of revolving credit available to you. So what is credit utilization ratio? It's the money you owe on your credit cards, divided by your total credit card limit. A good number to aim for is 30% or. Your total credit utilization ratio is the sum of all your balances, divided by the sum of your cards' credit limits. I'm hearing that 30% is a good credit utilization ratio but I'm Last week I had one credit card report a $1 balance, and none of my. You should use less than 30% of a $ credit card limit each month in order to avoid damage to your credit score. Having a balance of $ or less when your. Basically, your credit utilization ratio is calculated by dividing your current credit balance by your total available credit. Since your credit card debt. $ of 30% = $ x = $ If you have to use less than 30% of your total credit limit, you can use up to $ on your $ To calculate your credit utilization ratio, tally your outstanding debt across all revolving credit accounts. Next, add the credit limits of each individual. Calculating your credit utilization ratio is a snap. Simply “divide the balance of all your revolving debt by the total amount of revolving credit available to. Your credit card utilization ratio is an important factor in credit score calculations, accounting for 30% of your FICO score. Most credit experts recommend you. Use this calculator to estimate how long it could take you to pay off that debt based on your payment amount. Again, let's stick with a balance of $1, and an APR of Let's say your billing cycle was 30 days. Multiply your daily APR %) by your balance ($. Keeping below 30 percent credit utilization is a urban myth. Creditors more likely to grant you credit limit increase the more you use the card. Current balance · Enter an amount between $ and $1,, · $0 ; Interest rate (APR) · Enter an amount between 0% and 30% · 0% ; Payoff goal (in months). The interest rate on your credit card is the percentage of your purchases you pay to borrow the money. For example, say the balance of the principal on your. Typically, with the 15/3 credit card method, you pay half of your credit card statement balance 15 days before the due date, and then make another payment three. calculating your credit scores. Most prospective lenders are looking for a debt-to-credit ratio at or below 30%. A lower ratio may be seen as an indication.

10 Year Note

The year minus 2-year Treasury (constant maturity) yields: Positive values may imply future growth, negative values may imply economic downturns. 10+ Yr Treasury Bond TR USD. Price. +%. USD | Sep 6 PM GMT Open Price. Constituent Total Market Cap. m. Day Range. -. Find the latest CBOE Interest Rate 10 Year T No (^TNX) stock quote, history, news and other vital information to help you with your stock trading and. The iShares Year Treasury Bond ETF (IEF) seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities. The S&P U.S. Treasury Bond Year Index is designed to measure the performance of U.S. Treasury bonds maturing in 7 to 10 years. US 10 year Treasury, interest rates, bond rates, bond rate. View a year yield estimated from the average yields of a variety of Treasury securities with different maturities derived from the Treasury yield curve. Complete U.S. 10 Year Treasury Note bonds overview by Barron's. View the TMUBMUSD10Y bond market news, real-time rates and trading information. TMUBMUSD10Y | View the latest U.S. 10 Year Treasury Note news, historical stock charts, analyst ratings, financials, and today's stock price from WSJ. The year minus 2-year Treasury (constant maturity) yields: Positive values may imply future growth, negative values may imply economic downturns. 10+ Yr Treasury Bond TR USD. Price. +%. USD | Sep 6 PM GMT Open Price. Constituent Total Market Cap. m. Day Range. -. Find the latest CBOE Interest Rate 10 Year T No (^TNX) stock quote, history, news and other vital information to help you with your stock trading and. The iShares Year Treasury Bond ETF (IEF) seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities. The S&P U.S. Treasury Bond Year Index is designed to measure the performance of U.S. Treasury bonds maturing in 7 to 10 years. US 10 year Treasury, interest rates, bond rates, bond rate. View a year yield estimated from the average yields of a variety of Treasury securities with different maturities derived from the Treasury yield curve. Complete U.S. 10 Year Treasury Note bonds overview by Barron's. View the TMUBMUSD10Y bond market news, real-time rates and trading information. TMUBMUSD10Y | View the latest U.S. 10 Year Treasury Note news, historical stock charts, analyst ratings, financials, and today's stock price from WSJ.

Bonds ; ^FVX Treasury Yield 5 Years. (%). , % ; ^TNX CBOE Interest Rate 10 Year T No. (%). , %. 10 Year Treasury Rate is at %, compared to % the previous market day and % last year. This is lower than the long term average of %. The year Treasury yield, often referred to as the "year yield" or "year bond rate," is the interest rate at which the United States government borrows. The year US Treasury Note is a debt obligation that is issued by the Treasury Department of the United States Government and comes with a maturity of We sell Treasury Notes for a term of 2, 3, 5, 7, or 10 years. Notes pay a fixed rate of interest every six months until they mature. The ICE U.S. Treasury Year Bond Index includes publicly-issued U.S. Treasury securities that have a remaining maturity of greater than seven years and less. UK YR. , UK YR. , German Government Bonds (BUND) Please note that choices related to cookies and device identifiers are. Get our 10 year Treasury Bond Note overview with live and historical data. The yield on a 10 yr treasury bill represents the return an investor will receive. Futures and Options Last Updated PM CT. The Ultra Year T-Note was built to address marketplace demand for a futures contract more. U.S. 10 Year Treasury Note advanced bond charts by MarketWatch. View real-time TMUBMUSD10Y bond charts and compare to other bonds, stocks and exchanges. Daily Treasury Bill Rates. These rates are indicative closing market bid quotations on the most recently auctioned Treasury Bills in the over-the-counter. US 10 Year Note Bond Yield was percent on Wednesday September 11, according to over-the-counter interbank yield quotes for this government bond maturity. Tentative Auction Schedule of U.S. Treasury Securities. Security Type. Announcement Date. Auction Date. Settlement Date. 3-Year NOTE. US 10 Y TREASURY IDEASthis is what i think could happen short term form How has the yield of United States 10 Year Government Bonds changed over time? Historical prices and charts for U.S. 10 Year Treasury Note including analyst ratings, financials, and today's TMUBMUSD10Y price. Note: The following table displays data for the 20 most recently Year, CLF6, No, 08/15/, 08/15/, %, %. 3-Year, CLG4, No. Track 10 Year US Treasury Bond (10 Year Treasuries) Yields. 5-year daily-updated forecasts of the year Treasury note yield, based off futures data and market yields. The S&P U.S. Treasury Bond Current Year Index is a one-security index comprising the most recently issued year U.S. Treasury note or bond. The current 10 year treasury yield as of September 06, is %.